How much money is needed for a better future .How much can I save?What is the minimum sum that I should save?And the most important question – Why should I save?

Why to save -this is the root cause that causes trouble many families .People think why to save? , whenit’s going good without any savings. We have never saved any considerable amount until now even after that we are living happily , this means that we will not face any big problem later on too .No this is not true, whatever condition you are in will not remain same forever . If you are earning well now this does notguarantees that you will be earning a handsome amount in the future too. You do not hold any right to be in same condition. Suppose if you gets prey to some health condition that will need a fair amount to diagnose. Then what will you do? You will be left with only option to take loan and once a person fall prey to money lending his scope gets over. Then why to take such a risk? Whydon’t you start saving now? I am not even asking to save more, just 10 $ a month. Saving at regular intervals is a better alternative than saving in bulk.

Saving $10 a month will total $100 in a year, and if we include interest the sum will grow even bigger.

It’s not that hard to save $10 a month .These are the methods that you can apply for saving good sums, even more than $10 a month.

1- The basic strategy:

It’s not that hard to save $10 a month. On an average every human spends significant amount money on himself. If we cut a small portion of that money and deposit that amount in your family welfarefund, it will be the saving for the future of your family .Anybody can do that $10 per month is not a big deal.

Cut down your Dominoes and KFC’s cycles for the sake of better future of your family .Even if this method seems less interesting and functional this saves a considerable amount of money you can save more than $10 a month .Its truly based on how much you can contribute towards the betterment of your future indirectly.

And don’t forget to put the capital in bank. Without bank money loses its value as bank includes interest to the money .Slowly and steady your money grows.

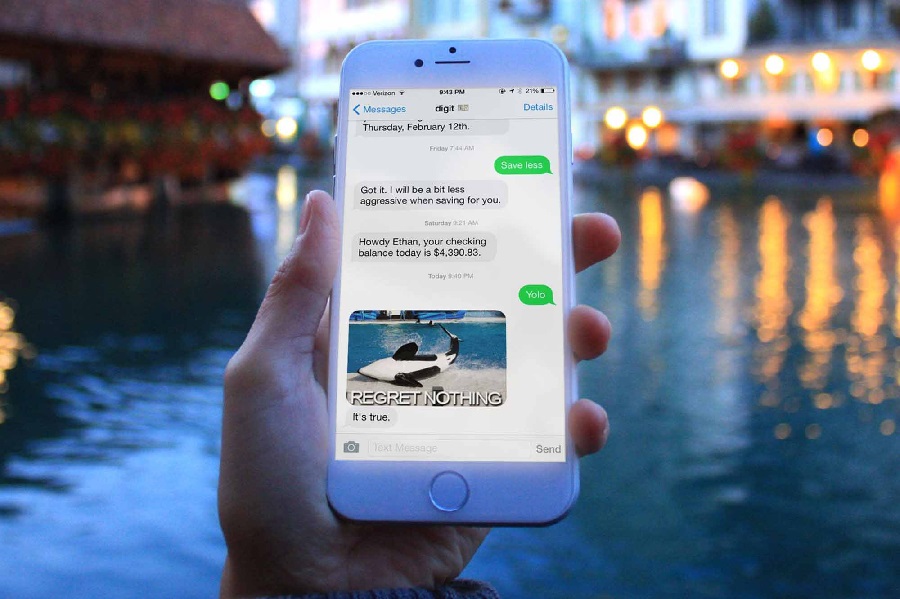

2- Savings- with the help of third party company.

This method involves taking the help of stock markets. Fix some amount for putting that in the market then wait for the right time. Wait for the market to slow down a bit. Why wait for the market to slow down? Think, because when the market slows down stock holders sell their shares, buy the shares of that stock that you think will grow in subsequent years. Some carefulness is needed while selecting the shares, do little homework and collect some data. Buy those shares whose market can boom in the coming years .It’s not just buying and leaving .Analyse, if the stock is going well. What to do if the stock unfortunately goes down?

If the stock goes down quickly sell it before it loses values or stick to it (it’s purely your decision).

Money with stock market is like hard nut to crack. But there is no fear in investing $10. If it works then congrats!! Otherwise try better with new stock .Yes the world of stock and shares it little absurd but it’s also the easiest way of achieving success.

3- What about buying assets and selling them later on??

This is one of the less tested things but it works If you have some marketing skills and had a good understanding of bargaining then you can try this . The all you had to do is to buy assets and then sell them .You can buy assets easily with $10 a month. Are YOU mad!!Howit’s that possible.

You can buy assets like cars and bikes and then can sell them later on. You must buy these assets with mortgages. If you are going this way then $ 10 dollars a month is somewhatless. You need to invest something bigger. You can start form $10 dollars and then try to gradually increase that .All you have to pay is low interest sums which will be fulfilled by your $10 dollar fund in banks that will make sums with compounded annually. After you pay your mortgage then you can sell it or whatever you what to do you can do let it be renting for taxi (in the example of a car) .You can think about that do it by now calculate your mortgagee form here,mortgagecalculatortop.com.

4- Save $10 dollars a month with the coming of family newer member:

This is the finest thing which should be practised by everyone .whenever a new born is welcomed to the family you must open a bank account where you can deposit $10 a month for the welfare of your child. So that you can use that sum when your child grows up for meeting his educational and financial things.

It’s not hard and fast rule that you fix $10 a month you can decrease or increaseamount as per your condition. I had taken $10 a month as an average amount. The more you can try with money – the greater amount you get and the lesser amount you take the lesser sum it will generate , but saving with lesser amount will be easy because cutting lesser from your expenses is much easier . Choose wisely and save judiciously.